CPF withdrawal refers to the whole process of having out cash from just one's Central Provident Fund (CPF) account in Singapore. The CPF is a mandatory cost savings plan for Doing the job people today in Singapore to set aside resources for retirement, healthcare, and housing requirements. There are several conditions under which CPF customers could make withdrawals as in-depth under:

Types of CPF Withdrawals:

Retirement:

On achieving the eligibility age (at present fifty five a long time aged), CPF members can withdraw their CPF discounts.

The Retirement Sum Scheme allows for every month payouts although holding a bare minimum sum during the Retirement Account.

Housing:

Funds through the Ordinary Account can be utilized for housing-similar functions for instance downpayment, home loan repayment, or getting assets.

Health care:

Particular health care disorders or hospitalizations might qualify for Medisave withdrawal to protect professional medical costs.

Schooling:

CPF Education and learning Plan will allow withdrawing resources for tertiary education charges and accredited programs.

Financial investment:

Users with more than the Basic Retirement Sum might make investments their excess funds through the CPF Expense Scheme.

Insurance coverage:

Premiums for certain life insurance policies is usually compensated working with CPF Standard Account cash.

Leaving Singapore/Everlasting Residency:

When leaving Singapore permanently, non-PRs can withdraw their CPF balances following immigration clearance.

Key Details to Note:

Different types of withdrawals have different eligibility standards and limitations based on unique necessities.

Early withdrawals ahead of retirement age are topic to restrictions and penalties.

Selected withdrawals call for supporting documentation or approval from suitable authorities.

Unused CPF personal savings carry on earning desire right up until withdrawn or transferred to some retirement account.

In summary, knowing the various forms of cpf withdrawals accessible is important for maximizing Rewards and scheduling properly for future fiscal more info needs in retirement, healthcare, housing, instruction, along with other critical expenditures all over distinct levels of lifestyle in Singapore.

Neve Campbell Then & Now!

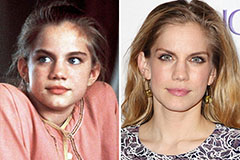

Neve Campbell Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!